Map growth opportunities, set goals and plan campaigns with our market data and peer analytics. Create instant maps of branch networks showing consumer and business demographic data. See interest rate movements. Identify opportunities with Nielsen Financial Clout® data to evaluate the demand for over 100 financial products by geographic market.

Chart exactly how you compare with your peers on key metrics like overhead, margins, capitalization and profitability. Make apples-to-apples comparisons with SNL’s powerful peer performance analytics. Curious where a data point on a public company comes from? “Source tagging” of GAAP financials takes you to the line item in the original document.

Price your offerings based on real-time competitive data - only SNL provides coverage of consumer deposit and loan rates. Balance market-driven decisions with internal goals. SNL’s platform makes it easy to include estimated cost of funds, perceived default risk, term liquidity and interest rate premiums.

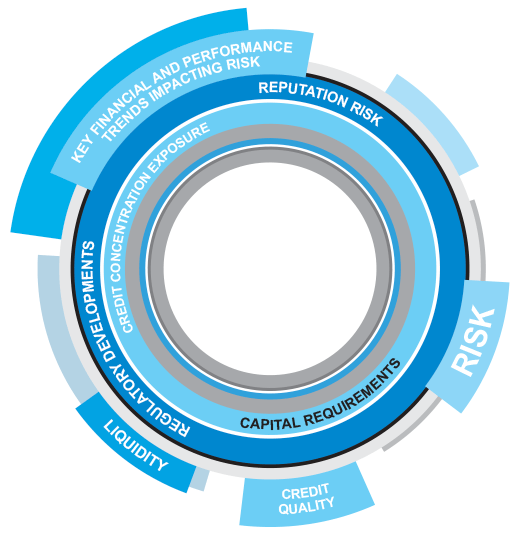

SNL offers a robust suite of data and tools to build risk models quickly, giving you more time for analysis. Track metrics critical to a bank’s success such as credit quality, credit concentration exposure, capital requirements, liquidity, reputation risk, Basel III Capital and key financial performance ratios versus peers.

Rate your bank’s value and plan M&A deals with SNL’s valuation data and models. See how you are performing against your institution’s defined goals. Give both shareholders and regulators a perspective on your financial health. Recognize capital needs. Analyze valuation of peer institutions. Identify M&A opportunities.

Spot regulatory red flags and prepare for examinations in less time. From loan portfolio analysis to stress-testing, identify key risks, regulatory issues and potential problems compared to your peers. View over 20 years of historical call report financials. Plot trending of key metrics.

Prepare board and investor presentations in substantially less time with less effort. SNL’s suite of solutions helps directors assess a bank’s condition and evaluate risk. You get data and templates like CAMELS indicators, deposit and loan composition, Canary Reports and Executive Compensation.